How Falling Interest Rates Could Affect Your Sale in Calgary

How Falling Interest Rates Could Affect Your Sale in Calgary This year the Bank of Canada has dropped interest rates in the country three times and a further shift in interest rates could be on the horizion. This would further impact the real estate market across Canada and would have significant effects on both buyers and sellers, creating opportunities and challenges in the housing market. 1. Increased Buyer Activity Lower interest rates tend to boost buyer confidence by reducing the cost of borrowing. As mortgage rates decline, more potential buyers are likely to enter the market. This increased demand can be especially beneficial for sellers, as it may result in more competitive offers. The anticipated interest rate cuts could create a surge in buyer activity. 2. Rising Home Prices As more buyers enter the market, competition for homes typically intensifies which can drive up home prices. Sellers who have been hesitant to list their properties during high-interest periods may seize this opportunity to get a better return on their homes. However, sellers should be mindful that while prices may rise, the increased supply from other homeowners trying to capitalize on the lower rates could balance out these gains. 3. Faster Sales With more buyers able to afford homes and interest in the Calgary market rising, sellers may experience quicker sales. The fall season, often a slower time for real estate, could see a boost in activity thanks to the interest rate drops this year, making it a strategic time to list a home. Those planning to sell should ensure their property is in prime condition to stand out. 4. Renovation Incentives Sellers can also take advantage of lower interest rates to finance renovations or upgrades before selling. Improving a home’s curb appeal or modernizing key features could help sellers attract more buyers and increase their home’s value. With lower borrowing costs, small investments in your property might provide a significant return. 5. Potential Long-Term Effects The impact of falling interest rates may be gradual, but the long-term trend favors sellers who plan ahead. As the market begins to adjust, some homeowners may face a balancing act—capitalizing on current high prices while avoiding the risk of increased competition down the line. Keeping an eye on mortgage rate trends and working with a real estate professional to time the sale optimally will be essential. Final Thoughts Falling interest rates in 2024 could create a favorable environment for sellers in Calgary, but understanding the dynamics of increased competition and buyer activity is key. Sellers should prepare their homes to stand out, price competitively, and consider the broader economic conditions as they plan their next move. By staying informed and working strategically, you can maximize your returns in this evolving market. For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved. This is not intended to solicit buyers or sellers currently under contract with a brokerage.

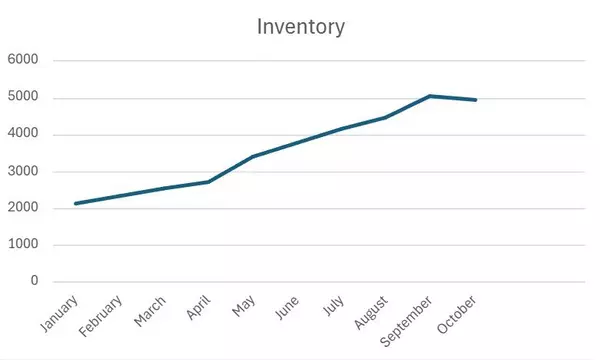

Should you Sell Now: Calgary Sees Low Inventory Levels Under $700,000

If your home is valued under $700,000, now may be a prime time to sell. Inventory in this price range is low, while buyer demand remains strong. This tight market could result in quicker sales and potentially higher offers for sellers. High Demand in the Sub-$700K Market Calgary's sub-$700K housing market is seeing strong demand due to affordability pressures. With fewer listings available in this range, buyers are facing stiff competition, driving prices up and creating a seller's market. Properties are selling quickly, often with multiple offers, giving sellers a unique advantage. Before jumping into the market, consider the following: Current Market Conditions: Prices in this segment are rising, and homes are selling faster. If you’re aiming for a quick and lucrative sale, now might be an opportune moment. Your Next Move: If you sell, where will you go next? While selling under $700,000 can be profitable, finding your next home might be more challenging due to limited inventory and rising prices in the same price range. Costs and Timing: If your home needs repairs or upgrades to maximize its value, factor in the time and costs associated with preparing it for sale. With demand high, even minor improvements can significantly boost your selling price. Demand in the Fall is Generally Lower: Something to consider is that people tend to settle in for the winter with the start of school and poorer weather. This may negate some of the attention your home might otherwise receive if it was listed in the spring. Selling in a low-inventory, high-demand market offers excellent opportunities, but make sure your next move aligns with your financial and housing goals. Consulting with a real estate professional can help you navigate the market and decide whether right now is the ideal time to put your home on the market.For more information, consider reading this article on CREB on this topic:https://www.creb.com/News/CREBNow/2024/October/New_listing_growth_driven_by_higher-priced_homes/ For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved.

Condo or House? Making the Right Choice in Calgary’s Tight Market

In Calgary's competitive real estate market, homebuyers often face the decision between purchasing a condo or a house. The right choice depends on various factors, including budget, lifestyle, and long-term goals. Here's a breakdown to help you decide which option is best for you. 1. Affordability One of the most significant differences between condos and houses is the cost. Condos in Calgary are generally more affordable, with average prices around $332,000, whereas detached homes average closer to $720,000. This price gap makes condos an attractive option for first-time buyers or those on a tighter budget, offering a more accessible entry point into homeownership. However, it’s important to factor in condo fees, which cover the maintenance of shared areas like landscaping, snow removal, and amenities. These fees can add up, potentially making a condo more expensive in the long run. On the flip side, houses come with their own maintenance costs. 2. Maintenance and Responsibilities Condos are typically lower-maintenance than houses, as the condo association handles most exterior upkeep. This can be a significant advantage if you prefer a "lock-and-leave" lifestyle with less time spent on yard work, repairs, or snow removal. In contrast, owning a house means taking on full responsibility for all repairs and maintenance. This includes everything from roof repairs to maintaining the lawn and driveway. While this may involve more time and cost, it also offers greater autonomy and the ability to make decisions without needing approval from a condo board. 3. Space and Privacy Houses offer more space, both indoors and outdoors. If you’re planning to start a family or need extra room for hobbies or guests, a house provides the flexibility to expand or customize your living space. Privacy is another key benefit, as detached homes offer more seclusion compared to condos, where you share walls and common areas with neighbours. On the other hand, if you prefer a more compact, urban lifestyle with proximity to downtown, a condo might be a better fit. Many condos in Calgary are located in prime areas, offering easy access to restaurants, entertainment, and public transportation. The trade-off is usually less privacy and smaller living spaces. 4. Long-Term Investment In terms of long-term appreciation, houses generally offer better returns than condos. Detached homes typically appreciate faster due to land ownership, which is a valuable asset that tends to increase in value over time. Houses also provide more flexibility for renovations and upgrades, which can further enhance their market value. Condos, while more affordable upfront, may not appreciate as quickly. Additionally, condo prices can be more volatile, influenced by market conditions and the building’s overall condition. That said, condos can still be a good investment, especially in Calgary’s growing rental market, where there's demand for rental properties in the downtown area. 5. Lifestyle Considerations Your personal lifestyle plays a significant role in this decision. Condos are ideal for those seeking convenience, with amenities like gyms, pools, and concierge services often included. They are also popular among professionals, retirees, and those who travel frequently, as they require less upkeep. Houses, however, are better suited for families or individuals who value space, privacy, and the freedom to make home improvements. If you have pets, children, or enjoy hosting gatherings, a house offers the flexibility and outdoor space needed to accommodate these aspects of your life. Conclusion Deciding between a condo and a house in Calgary’s tight market ultimately comes down to your financial situation, lifestyle preferences and situation, as well as long-term goals. A condo might be the right choice if you're looking for affordability, convenience, and low maintenance. On the other hand, a house could be the better option if you value space, privacy, and potential for long-term appreciation. Evaluate your priorities carefully before making your decision to ensure you make the right investment for your future. For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved.

Categories

Recent Posts