CREB Housing Statistics, January - October 2024

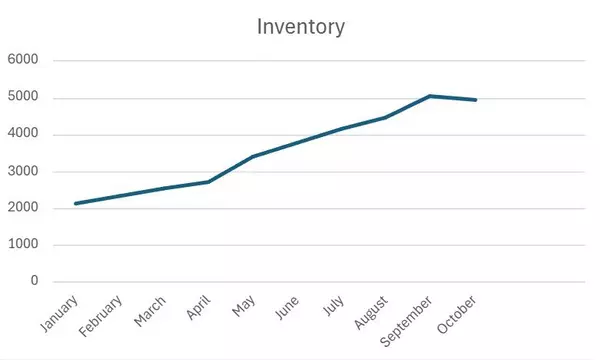

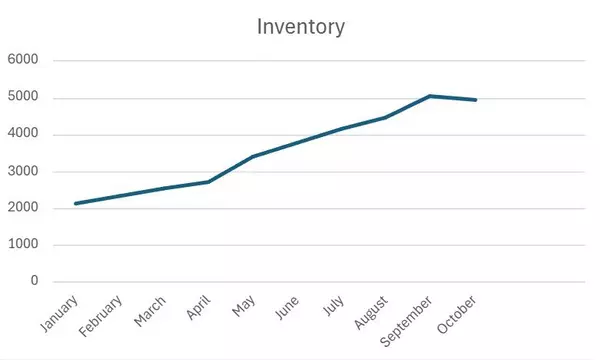

As we get close to wrapping up the end of the year, I find it interesting to look back at the housing statistics for the year so far and I figure you might be interested in seeing it as well. Here are some take-aways from the data below: From January 2024 to October 2024, there have been 23,903 homes sold and 33,733 homes listed. The average monthly inventory available over these 10 months was 3561, with the average days on the market being 24.8. Month Benchmark Price Sales New Listings Inventory Months of Supply Days on Market January $572,300 1650 2137 2150 1.3 34 February $585,000 2135 2711 2355 1.1 24 March $597,600 2664 3172 2532 0.95 20 April $603,700 2881 3491 2711 0.94 20 May $605,300 3092 4333 3402 1.1 19 June $608,000 2738 3798 3787 1.38 20 July $606,700 2380 3604 4158 1.75 24 August $601,800 2186 3536 4487 2.05 27 September $596,000 2003 3687 5064 2.53 28 October $592,500 2174 3264 4966 2.28 32 November n/a n/a n/a n/a n/a n/a December n/a n/a n/a n/a n/a n/a Source: https://www.creb.com/News/CREBNow/ For those visual learners out there, here are some graphs to look at: In January 2025, I will revisit this post and update it with the rest of the data from the year for those who find this information as fascinating as I do. For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved.

What the US Elections Could Mean for the Canadian Real Estate Market

With Donald Trump’s recent win in the 2024 U.S. election, Canadians may see ripple effects from his proposed economic policies, particularly his commitment to protectionist trade measures. As Canada’s largest trading partner, U.S. policy shifts can have far-reaching implications, and Trump's intentions to impose tariffs on imports could bring substantial changes. The Canadian housing market, closely tied to the economy’s overall health, could feel the impact through rising construction costs, shifts in foreign investment, and changes in consumer confidence. Trump’s stance on protectionism means tariffs may increase the cost of Canadian exports to the U.S., potentially reducing demand and lowering profitability for Canadian businesses reliant on American buyers. Additionally, his intent to revisit the Canada-U.S.-Mexico Agreement (CUSMA) raises uncertainties about future trade stability. For industries like construction, which heavily depend on affordable raw materials like steel and aluminum, these tariffs could increase costs, leading to pricier housing developments and potentially reducing housing affordability. For developers, higher construction costs may translate to slower project timelines or even reduced housing stock in high-demand urban areas. For Calgary and other major Canadian cities which are already facing affordability issues, these cost pressures could make homeownership more challenging for first-time buyers and renters alike. Rising costs for building materials could also affect housing in rural or suburban areas, adding additional obstacles to expanding Canada’s overall housing supply. The effects of U.S. trade policy shifts on the Canadian housing market may vary across regions. Provinces like Alberta and Saskatchewan, which are particularly reliant on oil exports to the U.S., could feel the brunt of reduced demand if trade tensions escalate. Decreased U.S. demand could lead to lower oil prices, reducing revenue for oil-dependent provinces and potentially leading to job losses. This economic slowdown could then impact housing demand as fewer people are willing or able to make significant financial commitments. Economic uncertainty from potential trade disruptions may also impact Canadian consumer confidence. As Canadians weigh the possible effects of Trump’s policies, they may hesitate on making significant purchases, such as buying a home. This is especially true if wage growth slows or job insecurity rises, leading to a cooling demand for real estate. In high-demand markets, a reduction in buyer interest could ease the rapid price growth seen in recent years, potentially stabilizing housing prices. While the full impact of Trump’s policies on the Canadian housing market remains uncertain, the potential for increased tariffs, rising construction costs, and fluctuating consumer confidence may introduce volatility. The Canadian housing market’s health depends on many factors and keeping an eye on U.S. trade policies will be critical as Canada navigates these challenges. For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved.

How Falling Interest Rates Could Affect Your Sale in Calgary

How Falling Interest Rates Could Affect Your Sale in Calgary This year the Bank of Canada has dropped interest rates in the country three times and a further shift in interest rates could be on the horizion. This would further impact the real estate market across Canada and would have significant effects on both buyers and sellers, creating opportunities and challenges in the housing market. 1. Increased Buyer Activity Lower interest rates tend to boost buyer confidence by reducing the cost of borrowing. As mortgage rates decline, more potential buyers are likely to enter the market. This increased demand can be especially beneficial for sellers, as it may result in more competitive offers. The anticipated interest rate cuts could create a surge in buyer activity. 2. Rising Home Prices As more buyers enter the market, competition for homes typically intensifies which can drive up home prices. Sellers who have been hesitant to list their properties during high-interest periods may seize this opportunity to get a better return on their homes. However, sellers should be mindful that while prices may rise, the increased supply from other homeowners trying to capitalize on the lower rates could balance out these gains. 3. Faster Sales With more buyers able to afford homes and interest in the Calgary market rising, sellers may experience quicker sales. The fall season, often a slower time for real estate, could see a boost in activity thanks to the interest rate drops this year, making it a strategic time to list a home. Those planning to sell should ensure their property is in prime condition to stand out. 4. Renovation Incentives Sellers can also take advantage of lower interest rates to finance renovations or upgrades before selling. Improving a home’s curb appeal or modernizing key features could help sellers attract more buyers and increase their home’s value. With lower borrowing costs, small investments in your property might provide a significant return. 5. Potential Long-Term Effects The impact of falling interest rates may be gradual, but the long-term trend favors sellers who plan ahead. As the market begins to adjust, some homeowners may face a balancing act—capitalizing on current high prices while avoiding the risk of increased competition down the line. Keeping an eye on mortgage rate trends and working with a real estate professional to time the sale optimally will be essential. Final Thoughts Falling interest rates in 2024 could create a favorable environment for sellers in Calgary, but understanding the dynamics of increased competition and buyer activity is key. Sellers should prepare their homes to stand out, price competitively, and consider the broader economic conditions as they plan their next move. By staying informed and working strategically, you can maximize your returns in this evolving market. For questions about buying or selling real estate, contact Ed Black today at (403) 830-8510. Ed BlackREALTOR® Copyright © 2024 All Rights Reserved. This is not intended to solicit buyers or sellers currently under contract with a brokerage.

Categories

Recent Posts